Bajaj finance limited started, its journey from Auto finance sector in 1987 and gradually it became India’s largest NBFC company , which became quite famous especially in rural areas due to its scheme or attractive customer service. Bajaj Finance is India’s largest Non-Banking finance[ NBFC]company whose head quarter is in Pune.it is the only NBFC sector in India which holds a portfolio of about 73 million customer across India.

Most recommended visit : SUZLON ENERGY SHARE PRICE TARGET 2024 T0 2025

| MARKET | CLICK4INVESTING.COM |

|---|---|

| MARKET CAP | ₹ 4,76,567 Cr |

| HIGH/LOW | ₹ 8192/5486 |

| STOCK P/E | 36.3 |

| ROE | 23.5% |

| ROCE | 11.8% |

| DIVEDEND YIELD | 0.39% |

| BOOK VALUE | ₹ 988 |

| FACE VALUE | ₹ 2.00 |

Most recommended visit : IREDA SHARE PRICE (2024)

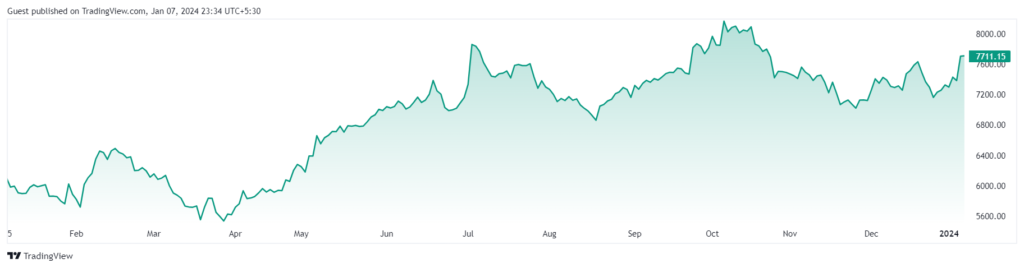

ONE YEAR CHART OF BAJAJ FINANCE

CREDIT SOURCE IMAGE : TRADING VIEW

Most recommended visit : Adani Enterprises Share Price 2024 [AEL]

PROMOTOR HOLDINGS

| HOLDINGS | MARCH 2021 | MARCH 2022 | MARCH 2023 | NOVEMBER 2023 |

|---|---|---|---|---|

| PROMOTORS | 56.12% | 55.86% | 55.91% | 54.78% |

| FIIS | 24.06% | 21.41% | 19.16% | 21.31% |

| DIIS | 9.08% | 11.22% | 12.92% | |

| PUBLIC | 10.57% | 11.15% | 11.75% | 10.13% |

| GOVERNMENT | 0.00% | 0.00% | 0.07% | 0.07% |

BUSINESS

BUSINESS :

BAJAJ FINANCE provides instant loan app for its loans or schemes ,so that the services are available 24×7. BFL gives UNSECURED loan and quick credit, so there is a demand for it in the market or along with .BFL also invests in housing finance, Equities, Securities, It would not be wrong to say that it has provided complete loan solutions by itself. hello to your customers

Bajaj Finance active network distribution is 133200, Bajaj Finance has approximately 3504 branches in India out of which 2136 branches are only in rural areas, all this has made BFL the market leader of its sector.

Most recommended visit : 2024 GOYAL ALUMUNIUM SHARE PRICE TARGET

| PROS | CONS |

|---|---|

| * Last quarter company give good report | * 7.80 times stock trading from its Book Value |

| * CAGR over last five year company delivered outstanding growth repot 35.8% | * 1.09% Decreased promotor holdings |

SHARE PRICE TARGET 2024,2025,2025,2026 TO 2032 [ “a Guess Can Be Made “]

| YEAR | MINIMUM PRICE TARGET | MAXIMUM PRICE TARGET | AVERAGE PRICE TARGET |

|---|---|---|---|

| 2024 | ₹6900 | ₹7940 | ₹7800 |

| 2025 | ₹7600 | ₹ 8490 | ₹8200 |

| 2026 | ₹7910 | ₹ 8800 | ₹8400 |

| 2027 | ₹8000 | ₹9060 | ₹8670 |

| 2028 | ₹8090 | ₹9080 | ₹8810 |

| 2029 | ₹8200 | ₹9350 | ₹9100 |

| 2030 | ₹8700 | ₹9544 | ₹ 9188 |

| 2031 | ₹9380 | ₹9800 | ₹9605 |

| 2032 | ₹9300 | ₹10080 | ₹9690 |

BASSICS : Bajaj is very famous for its instant personal loan which easily gives credit to the account of any salaried or individual employee in few simple steps, this business policy is quite unique or attractive . It provides pre-approved loans to many such customers, all this extra ordinary thing makes Bajaj the market leader in its [NBFC] sector. Last 10 year’s Bajaj Finance ensured a profitable Growth which is benefits for his shareholders ,The one who would have invested in Bajaj 20 years ago would be enjoying investment happiness today.

UNSECURED LOAN TYPES: Business Loan, Working Capital Loan ,Invoice Financing ,Home Loan, Car Loan ,Credit Card Loan.

IMPACT BAJAJ FINANCE IN FUTURE: Bajaj may face problems in future due to some things like , interest rate , Peer competition, regulatory changes.

Most recommended visit : RAJNANDANI METALS(2024) PRICE

FAQ:

** Is Bajaj finance Banking Finance service !

No, its not it is Non Banking Finance Service

- Who is founder of BAJAJ FINANCE !

- SIR RAHUL BAJAJ is founder of Bajaj Finance

- Who is current Managing Director of Bajaj Finance !

- RAJIV BAJAJ is current Managing Director

- What is the Old Name of Bajaj Auto !

- Bachraj Trading Corporation is old name , 21st-June name was changed to Bajaj Auto.

- Does Bajaj Finance pay dividend !

- Yes :Bajaj Finance pays dividend to its investors

- Is Baja Finance listed in the Indian Stock Exchange !

- Yes ! Bajaj Finance listed NSE[National Stock Exchange] or BSE [Bombay Stock Exchange] both exchange

Most recommended visit : Hindustan Aeronautics Ltd(2024)

Write article about Ashok Leyland

Bajaj finance split soon